Is it Legal?

Category: Wealth Creation

How many ways do we know to earn extra money… legally?

- Get a Job

- Get a Second Job

- Get a Third Job (if there are even enough jobs out there)

- Get a formal education to prepare for a ‘career’ that is, after all, a job.

- Work longer hours / extra shifts

- Sell stuff lying around the house

- Buy and Resell stuff that laid around other people’s homes (flea market, etc)

- Borrow money (loans, credit cards, etc.)

- Provide a service / skill-set people are willing to pay for

- Generate Rental Income from property you own by becoming a landlord

- Trade in Stocks / Bonds / Money Markets / Real Estate for Capital Gains and Interest Income

- Create, Craft, Build, Grow, or Construct something someone may want to buy

- Sell your blood

- Buy Lottery Tickets and Hope to win

I’ve done ALL of these (except sell my blood, yuck), how about you?

Perhaps, like me, you’ve been taken advantage of in the past. Paying too much for something, taking ownership of a new purchase only to find out it’s defective, or just buying something you neither need, nor want, because you felt “pressured”, or got duped. Ever buy an Investment that either didn’t pan out, or actually lost money? This is why terms like “Caveat Emptor” (Let the Buyer Beware) came about long ago. We each must learn, through education, training, and trial and error, how to protect ourselves from threats of all kinds. That’s life.

Years ago I was approached to join a Multi-Level Marketing (MLM) opportunity. I wouldn’t even give it a serious look because of all the negative bias I’d heard about “those kind of companies”. Perhaps you’ve heard of major MLM companies being prosecuted for deceptive practices. For example: Amway was the big one in the 1970’s and Herbalife got into hot water in 2016.

Sometimes it seems safer to cloak ourselves in cynicism, than to diligently research additional ways to earn extra money legally, and ethically. For the longest time, I stayed in my comfort zone… a paradigm of working harder, getting more education, getting a better job, and repeat. But, there are only 24 hours in a day, and a body can only work so hard for so long. Eventually, something’s got to give.

As I found out in my life, when you lose your health, nothing else matters. In fact, if it wasn’t for becoming physically disabled by a chronic “invisible” illness so many years ago, I’d probably still be advancing in my corporate career field and planning for retirement. That part of my life is long over. My new reality, for many years, became one of surviving instead of thriving. But this isn’t about that.

What I know for sure is we will all, eventually, be confronted with physical impairments and financial challenges. Being forced to cope with life-altering illness at an earlier age than many, has prepared me to be of service in this life in another way. Focusing on my own health and wellness, not for money, or vanity, or validation from others, has become my full time “job”. This will also become your full time job if you’re blessed to live long enough.

My hope is that others may benefit from my experiences and become aware of more choices that may improve the quality, and duration, of their lives. It is from this new reality (when physically able to) that I took another, much closer, look at Multi-Level Marketing. I started with skepticism…

What’s all this talk about a“Pyramid”?

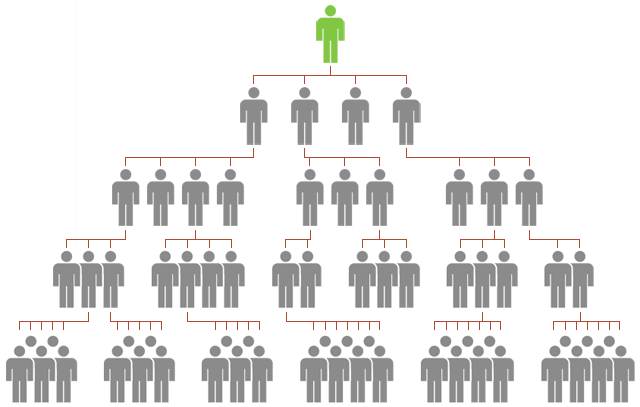

Multi-Level Marketing (MLM) companies get labeled a “pyramid” because of what the customer/distributor hierarchy, and pay plan, look like in a diagram. An individual distributorship (independent business) usually starts with one motivated person who is also a consumer. Other people enroll in that person’s organization, either as business building entrepreneurs or product-only customers. They are often referred to as a ‘downline’. The entrepreneur may then be paid a % of the consumer purchases made from their downline (as per that MLM’s published pay plan).

Multi-Level Marketing (MLM) companies get labeled a “pyramid” because of what the customer/distributor hierarchy, and pay plan, look like in a diagram. An individual distributorship (independent business) usually starts with one motivated person who is also a consumer. Other people enroll in that person’s organization, either as business building entrepreneurs or product-only customers. They are often referred to as a ‘downline’. The entrepreneur may then be paid a % of the consumer purchases made from their downline (as per that MLM’s published pay plan).

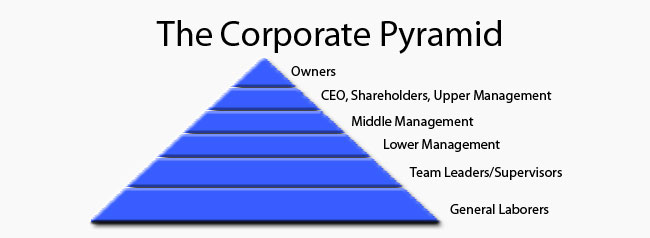

Traditional corporate hierarchies are also shaped like pyramids. The main difference being -anyone- in an MLM structure (regardless of age, race, gender, education, background, religious, sexual or cultural orientation) can make Way more money than people above them in the hierarchy by simply working harder.

Wouldn’t you rather earn 1% off of 100 people’s efforts than 100% off of just your own efforts? That’s what corporations do… why not you? If you could make a dollar from one consumer purchase, what could you earn if 1,000 consumers made that same purchase? What would that income look like if 1,000 people repeated their purchase every month? That’s one way MLM organizations can generate value… by building a structure for product distribution where lots of people each do a little bit. Now, what if the manufacturer also paid incentives to help you build your network of consumers? Increased product volume helps the manufacturer, and they Reward those who are responsible (Distributors AND Consumers). But the ‘possibility’ of earnings should not be confused with ‘expected’ earnings.

What are the chances that you’ll make 10x more money than your boss? In traditional corporate environments, including non-profit corporations, job positions and pay scales are rigidly structured. People are paid in a Linear fashion (hourly wages, salary, or commissions). The corporate business model, which determines your maximum pay, is simply not designed to make workers independently wealthy.

Working hard does not always translate into immediate, or significant, rewards, and “loyalty” no longer translates into job security. So how do we improve our financial situation? Historically, advancement puts the onus on the employee to obtain more education, work longer hours, and simply do more.

But is your climb “up the corporate ladder” blocked like 3rd class stairwells on the Titanic? Today’s corporate senior executive positions are essentially exclusive private clubs for the wealthy and privileged. Average folk stand little chance of achieving the kind of income the owners or upper management do, no matter how hard they work, or how good they are. This structure, however, is accepted as ‘normal’… even by those who toil at the bottom within it. It is legal, however, because people exchange their time, skills, and effort, for pay… no matter how fair or unfair that may be.

But is your climb “up the corporate ladder” blocked like 3rd class stairwells on the Titanic? Today’s corporate senior executive positions are essentially exclusive private clubs for the wealthy and privileged. Average folk stand little chance of achieving the kind of income the owners or upper management do, no matter how hard they work, or how good they are. This structure, however, is accepted as ‘normal’… even by those who toil at the bottom within it. It is legal, however, because people exchange their time, skills, and effort, for pay… no matter how fair or unfair that may be.

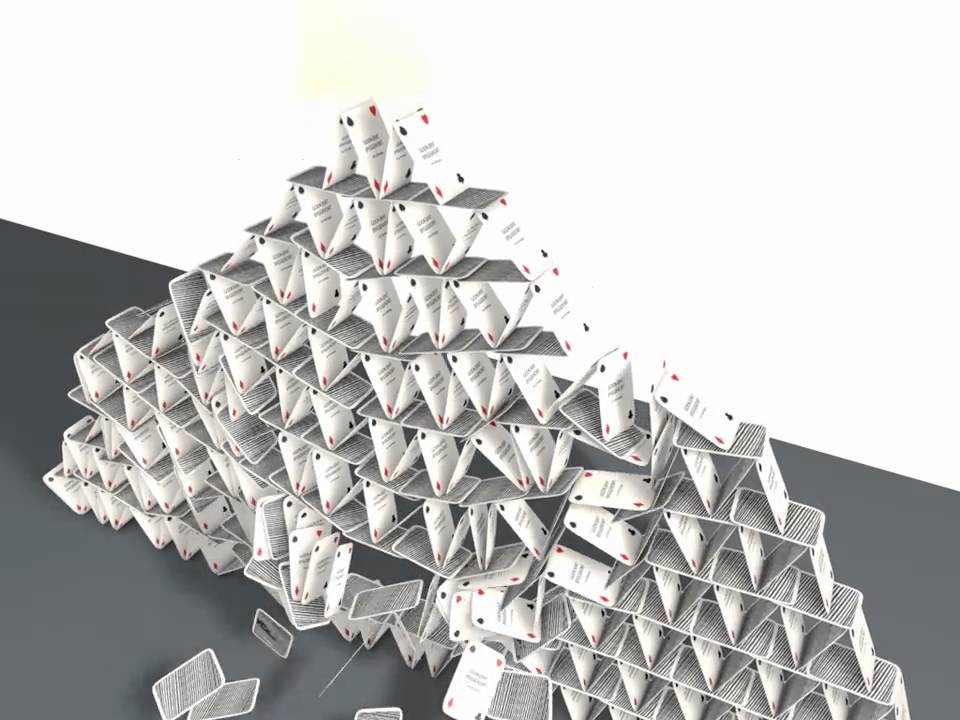

When is a Pyramid illegal?

An illegal pyramid scheme occurs when the purpose of recruiting others is to get them to ‘buy into’ your organization **Without Goods or Services being the primary purpose of the financial transaction**. The FTC has very strict criteria governing the legality of MLM’s. For MLM organizations to be legal, there must be a legitimate product/service that gets exchanged, at a reasonable price, without making false claims. In an ethical MLM organization, distributors who excel at helping other people realize their own goals often succeed beyond their wildest dreams.

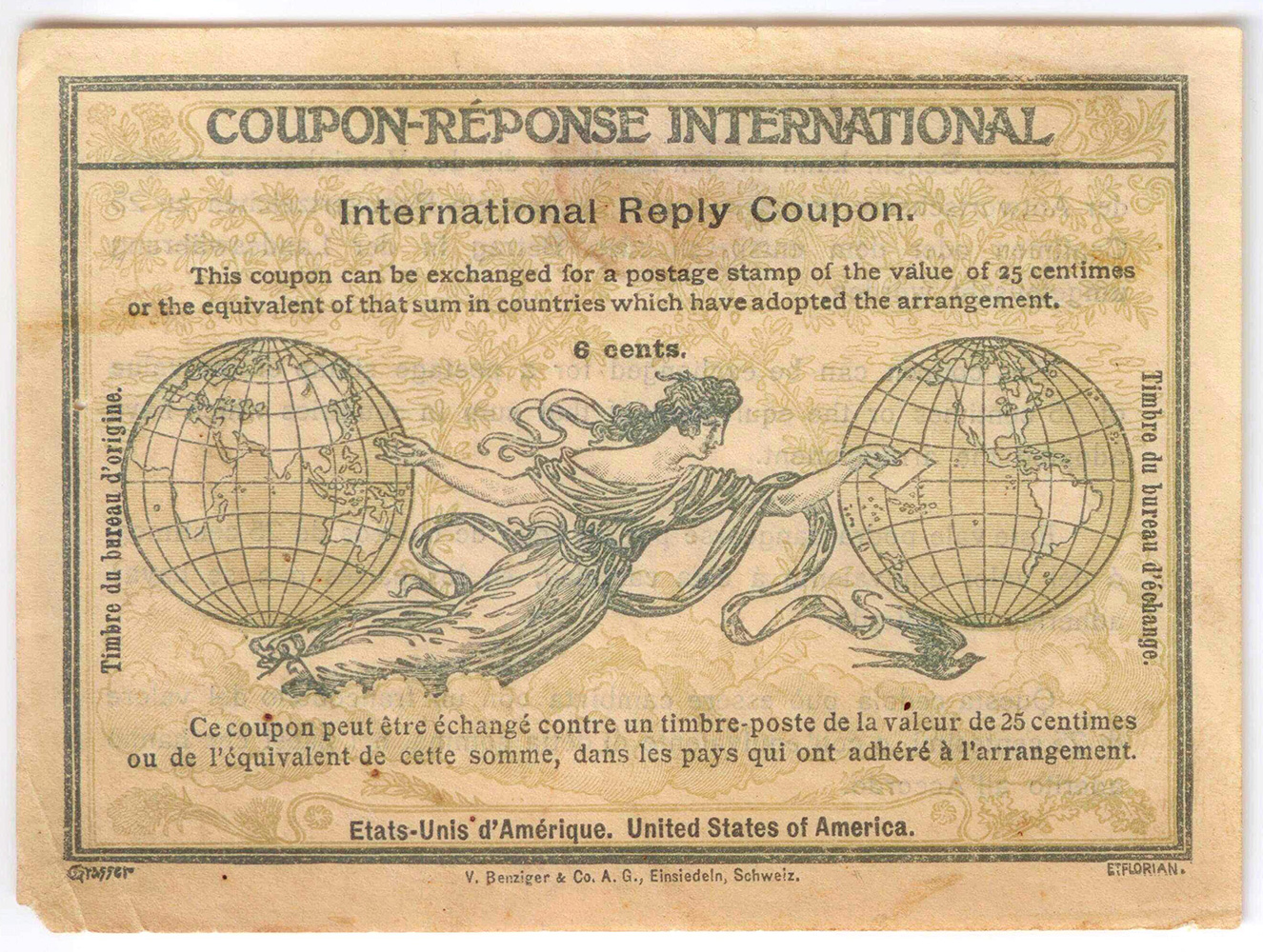

Ponzi Scheme

“Ponzi Scheme” is a term used to describe an illegal investment scam where the only “product” is profit. Named after Charles Ponzi, a poor immigrant to America, who sold a ‘postal reply coupon’ scheme as a way to exploit a legitimate international postal loophole. He was a huckster… very persuasive, confident, and reassuring in his claims. Ponzi focused on people’s greed and desperation. Folks would purchase paper coupons and were promised an incredible return the longer they held that “investment”.

The Illegal part happened because there was no real product, just a piece of paper. Ponzi used money coming in from new coupon sales to pay the promised return to others redeeming their coupons. Essentially a “Peter to Pay Paul” Scam, there is no actual investment in a capital good. It is merely a worthless paper ‘promise’ to get good hardworking people, who can least afford it, to turn over much of their life savings in the hope and expectation they can double or triple their money.

Why would people do this? In the 1920’s, there was a huge divide between the “have’s” and the “have-nots” (kind of like today between the 1% and the rest of us). Back then, there was no thriving middle class. No other savings plans or investment opportunities existed for most Americans 100 years ago. Hardworking laborers seeking to ‘get ahead’, became susceptible to money-making schemes. Ponzi lived (for a while) as the ‘Warren Buffet’ of his day. A lavish lifestyle can often prove very seductive to those living without. But, we don’t always see things the way they are, we see them the way we are.

Some people did, in fact, make money in Ponzi’s scheme if they got out early and stayed out… kind of like leaving the casino when you’re ahead. Those that became convinced the profits could never end, and treated it as a long term investment, were the hardest hit. These people simply “let it ride” and rarely redeemed their coupons. They weren’t gamblers who knew the risk, they were poor people who were deceived.

Newspaper stories raised suspicions and federal investigators ‘followed the money’. When people stopped investing, he could no longer pay back thousands seeking to redeem their coupons at the promised markup. Much like a run on a bank (but without the insurance), panic would ensue whenever enough coupon holders feared their investment was in jeopardy. He actually survived several of these scares because enough people (who didn’t believe the “fake news” of the day) held onto their coupons. But Eventually, Ponzi’s unsupported pyramid of deception collapsed.

What Consumer Protections are there? Back then, very few. Today, the SEC may be tasked with investigating and prosecuting illegal Ponzi schemes. The FBI also investigates and closes down people who swindle others for their own personal enrichment.

The Heinousness of his scam was that it targeted average, often illiterate, hard-working, honest, salt-of-the-earth people who could least afford to lose whatever savings they had scraped up from years of toil.

Ponzi went to jail and his name is forever associated with investment scams. He was eventually deported back to Italy and died penniless. Even today, the people of greater Boston area where he started, retain a learned cultural skepticism towards “get rich quick” schemes.

Ponzi Schemes Today

As we’ve seen in modern times with the Bernie Madoff scandal, no one is immune to investment fraudsters using ‘in-group’ affinity to anesthetize good people into making bad investments. Like Ponzi, he appealed to his own ethnic community. However, Madoff victimized wealthy individuals, families and even legitimate charitable organizations, to the tune of Billions of dollars. Like Ponzi, Madoff presented himself as an Investment Advisor you could trust. Neither were Multi-level Marketers, but both were con-men, liars, and imposters of the highest order. Yet dishonest scams masquerading as legitimate businesses are still prosecuted all the time. A particularly difficult racket to spot is money laundering. Don’t think it’s got to be ok just because some famous person or athlete puts their name on it. Here’s one the Department of Justice handed down just in 2017.

So why do some people think all MLM’s are a Ponzi Scheme?

Unscrupulous people find their way into every industry to take advantage of people. That does not make the industry itself illegal. If that were true, our entire banking industry and Wall Street would be illegal. Even when everything is above board, that still doesn’t mean it’s easy to do. There are no honest ‘get rich quick’ schemes. True success starts with a dream, and comes from helping others succeed in their dreams.

Here are some questions to ask Before Spending Any Money…

Check the FTC’s guidance on Multi-Level Marketing,

and I would ask these additional questions:

- How long has the sponsor’s Parent company been in business?

- Do they have a legitimate product? (backed by more than just claims) Check the FDA site for recalls

- Which came first, the product or the company? Some companies have been formed specifically with MLM in mind, and are only populated with products as an after thought.

- Is the Parent company Publicly or privately owned? Why is this important? Read my Blog post here

- Are there high initial entry costs? ongoing ‘membership fees’ or ‘pay-to-play’ requirements?

- Are there ongoing product purchase requirements or monthly recruitment quotas?

- Are promotional and advertising materials offered FREE from the Supplier?

- Are Independent Distributors charging exorbitant amounts of money for post-enrollment ‘training’ to other independent distributors?

- What marketing methods does your sponsor use to create product volume?

- Is your sponsor also simultaneously an independent distributor of one or more other product suppliers?

The bottom line for me: It MATTERS with whom you do business.

Do your Due Diligence. Choose honest people with good intentions and no hidden agendas or ulterior motives. If you wouldn’t trust them in your home, why would you trust them in your business?

Download our Free e-book to Learn More

Facebook Comments